The Market Equilibrium Trend changes from Supply-to-Demand to Demand-to-Supply Ascendancy

In number of articles, I presented the theory of Market Economics as based on the conception of the tipped-off, from a Supply to a Demand driven Global Market Trend to a Demand-to-Supply Trend that was prompted by the ongoing Globalization and rising Productivity, which new Trend is consequential to the improving Technologies, the China’s Industrialization, the Outsourcing and Moving of Manufacturing, the Internet and etc developments that have accelerated these processes for the last 20-25 years. This article uses available data and respectful papers to prove the validity of such conception. And, brings upfront the necessity of comprehensive assessments and the needed changes of Economics to meet these new challenges.

The beginning of the 21st Century showed the tremendous effect, technologies and globalization, has on the concentration of industrial production into a few players globally. The transnational corporation along with the Chinese state enterprises have succeeded in achieving immense capacities and potentials for swift expansion by using a large pool of international capital, improving technologies, better controlled management, and by outsourcing and moving of production (for transnational corporations mostly). Consulting companies, e.g. BCG, Ernst & Young, Deloitte Consulting, contributed globally to share competitive practices, compare managerial and technological approaches that boosted competition and productivity. The diversion between the large transnational corporation and Chinese state owned companies from one side and the small and medium companies and most developing economies from another has grown larger than ever, living the last in competitive disadvantage and thus prompting inequality not just between rich and poor in the most developed economies, but also between developed economies (including China) and the most developing ones. Even further, the success of their improvements has reduced the employment elsewhere, ironically “supported” by a shrinking and inadequate global demand, more like a “Catch 22’s perpetuum mobile”.

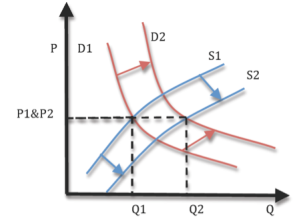

It has been argued that the “bottom billion may be trapped in poverty” (Collier 2007). The undeveloped markets i.d. economies along with the deteriorating such as Detroit will have to wait for their turn, until the giant industrial economies like China become rich and uncompetitive in manufacturing. When the technological changes have made manufacturing more capital and skill intensive. So, it is creating fewer jobs. Some form of pre-mature deindustrialization seems to have set in (Rodrik, 2013, Subramanian 2014). This might be because consumers and households in developed countries now spend a lot less on manufactured goods than they do on services. This can put a limit to how fast the latecomers to development can grow through industrialization. While jobs in the industrial sector are shrinking globally. In the past, technological and structural underdevelopment consisted of shortages that provoked inflations; however, in the presence, excessive manufacturing capacity and rising productivity brings high unemployment and prompts deflations. Large retailers have penetrated markets and Internet sales have brought international goods to most markets, aiding the high manufacturing capacity. The market equilibrium on a macro economic level has become less perceptive to Supply than to Demand factor.[1] (see Drawing 1)

Large Transnational Corporations employ about 0.82% of the global workforce taking more than a quarter of the global wealth adding to the widespread poverty[2], deteriorating middle class, rising inequality, and the Earth pollution, whereas poverty brings primitive fossil fuels heating, woods cutting, old car usage[3], and etc[4].; and, deteriorating middle class adds to the poor; what about excessive inequality? – It just accelerates the whole process, but most important it prompts the overall economic stagnation: market disequilibrium caused by inadequate demand. Most of the Emerging Markets are hit by the same problems as the poor in the Developed Markets are, whereas the results are all the same no difference between Detroit and many Undeveloped or Emerging Markets: factors affecting the market equilibrium from the demand side, expanding Earth pollution, rising Discrimination and Radicalization caused by the economic upheaval of the 2007-9 recession and sluggish recovery. While the existing middle class has shrunk the poor was not given opportunities of rising to a middle class. Shrinking fiscal reserves and trickle-down ideologies have imposed austerity policies to infrastructures, social and educational expenses, thus holding high unemployment from Spain, Portugal, and Italy to Greece, the living standards are free falling, or Bulgaria, and Romania in the European Union, where slow business activities and lack of vivid improvement prevails. However, from Guyana, Peru, and Ecuador to Bolivia, Paraguay and Colombia in South America, from Guinea-Bissau, and São Tomé and Príncipe to Republic of the Congo, Chad, and Zimbabwe in Africa, from Afghanistan, Tajikistan, and Yemen to Pakistan, Uzbekistan, and Iraq in the Middle East, etc. markets are underdeveloped, infrastructure is either undeveloped or deteriorating, corruption is roaring along with poverty and disarray! The world was never better, but it had never possessed the technologies nor the organization to be any better, but for the last few decades. In the past, the weak technologies and markets were a natural promoters of underdevelopment, poverty and the related discrimination and nationalism, but with the great technological inventions and improvements, the Internet and WIFI, the open globalized marketplace, and etc to have such roaring poverty and underdevelopment is inexcusable, thus I consider that if these if properly used these new developments would make the world advancing into a new era of prosperity; however, only a new system of economics that apprehends these new developments and abstract itself from the trickle-down philosophy would succeed in such improvement.

Joshua Konov, 2014

[1] [PDF] Global steel 2014 – Ernst & Young Excess capacity is the biggest threat to the sector While there are signs that the outlook for demand is slowly improving, excess capacity remains the biggest threat to the steel sector. The sector is straining under the relentless pressure caused by years of excess steelmaking capacity and low margins. While some capacity is expected to be removed over the next decade, the announced addition of capacity by steelmakers out to 2020 shows that investment is still alive and well. To counteract the investment in new steelmaking capacity, we estimate that about 300 million tonnes of steelmaking capacity needs to be closed for the industry’s profit margin to reach unsustainable level, and raise the capacity utilization rate for the sector globally, from below 80% to more than 85%. Permanent shutdown of capacity is the only real solution to bring balance to the market but in the short term it is difficult to see this happening given state participation in many countries and additional political incentive to retain employment, regardless of profitability. The overall net effect, however, has been an increase in steel making capacity despite the Chinese Government mandating 80 million tonnes of capacity to be removed restructuring and consolidation in the Chinese market, a handful of large Chinese steel players will emerge, leading to global competition intensifying. “Steel producers should test the vulnerability of their business models and the resilience of their strategies to ensure sustainable growth.“ Anjani Agrawal

[2] “It has been argued for more than 200 years that economic growth is associated with the manufacturing sector (Baumol 1967, Dercon 2014, Gelb 2014, Kaldor 1966, Rodrik and McMillan 2011, De Vries et al 2013, Winters 2010, UNIDO 2009). Services have been considered non-tradable, menial, low productivity, and low-innovation (McCredie and Bubner 2010). The East Asian Tigers are the classic success stories about how the conventional path to growth goes through industrialization. However, this conventional path to development seems to have hit a roadblock in other regions, especially low-income countries in Africa and South Asia. Indeed, several high level reports on Africa—the 2014 African Transformation Report, the African Union’s Agenda 2063, the African Development Bank’s long-term strategy, the UN Economic Commission for Africa’s 2013 report, and UNCTAD’s 2012 report—have all raised concern about limited industrialization and technological progress. Indeed, in many African economies, manufacturing—the sector that led rapid development in East Asia—is declining as a share of GDP. The worry is that without a major transformation, Africa’s recent growth spurt may soon run out of steam.”

[3] Mongolia is the world’s most polluted country and also home to one of the world’s most polluted cities — Ulaanbaatar. The country’s main sources of pollution are its traditional coal-fueled stoves and boilers used for heating and cooking, as well as congested traffic and old cars. Heating is essential for the survival of its people for about eight months of year. The country uses everything from coal, wood to refuse, such as black tar-dipped bricks and old car tires to fuel stoves and boilers World’s Most Polluted Countries

[4] Neither of the top 10 polluted sites are in the U.S., Japan or western Europe. However, a lot of the pollution in poorer countries has to do with the lifestyles of richer ones, noted Stephan Robinson of Green Cross Switzerland—for example, a tannery in Bangladesh that provides leather for shoes made in Italy that are sold in New York City or Zurich. “The pollution we see is not coming from the major global industrial companies, it’s all from small mom-and-pop shops, which prepare the raw materials that we then later use,” Robinson said. Or, in the case of Agbogbloshie, Ghanaians are polluted by the electronic devices Westerners have already used. Local people in such areas, Robinson added, “are very often polluting their environment not because they think it is fun but because it is a question of survival.”

Drawing 1

With the raised demand (from D1 to D2) the high Elasticity of the supply that has come with the ongoing Globalization and rising Productivity matches the demand by expanding (from S1 to S2) and thus living the same market equilibrium price (P1&P2). Such Supply Elasticity is probable to a certain turning point which approximate quantities are estimated (see next paper on “Probability Factors of Quantities Proximity”)